By Josh Carson, Vice President of Axcess Surety

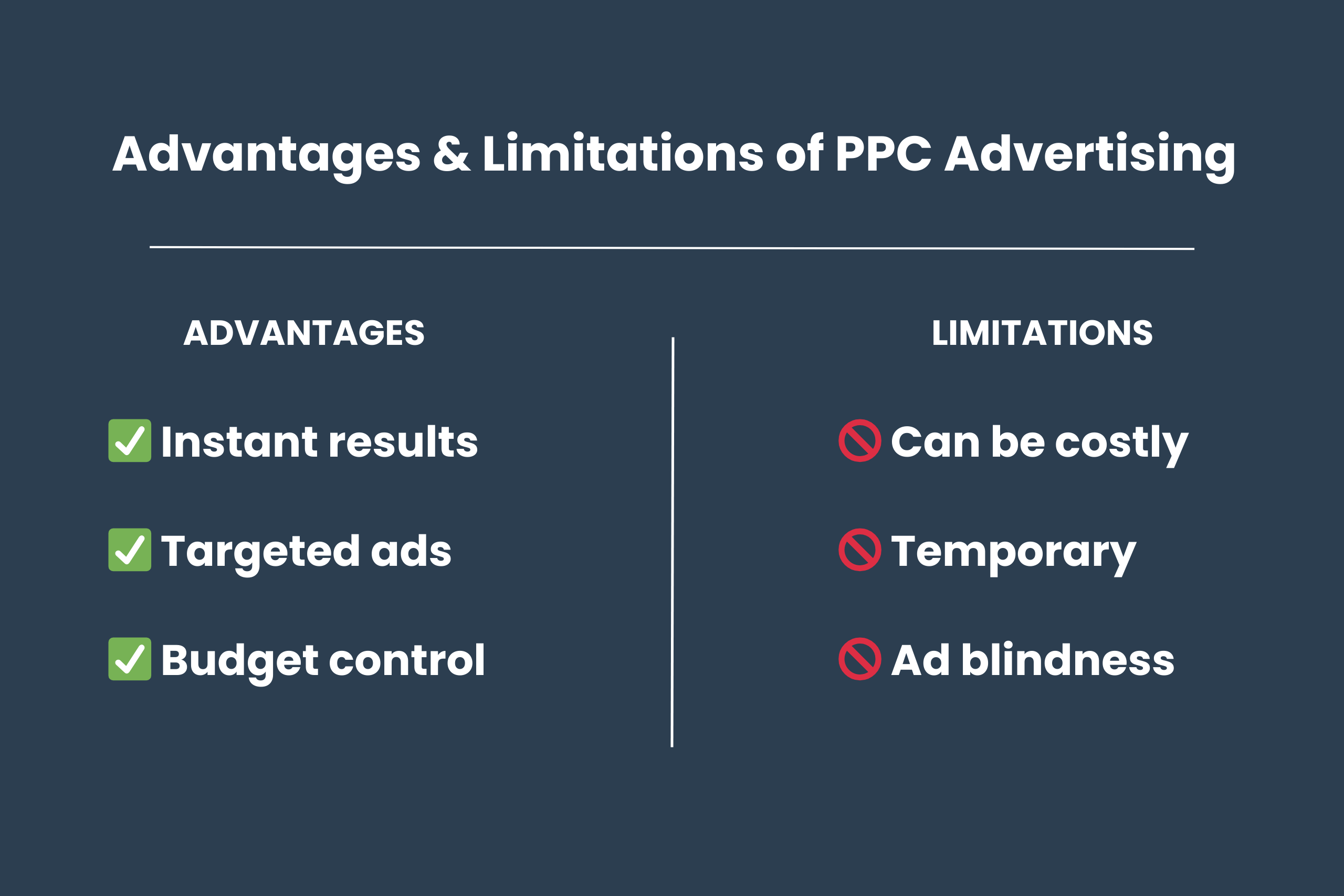

Roofers who can obtain surety bonds can set themselves apart from the competition and win more work in any construction economy. However, this is especially true when the overall economy pulls back or goes into a recession. Surety Bonds provide project owners, lenders and general contractors a means of protecting themselves and creates an opportunity for roofers who can obtain them.

Following the Great Recession in 2008, many lenders and General Contractors required all subcontractors to provide surety bonds. With price escalations and rising interest rates, we may start to see these requirements again and roofers should start preparing so they can capitalize on new opportunities.

What is a Surety Bond?

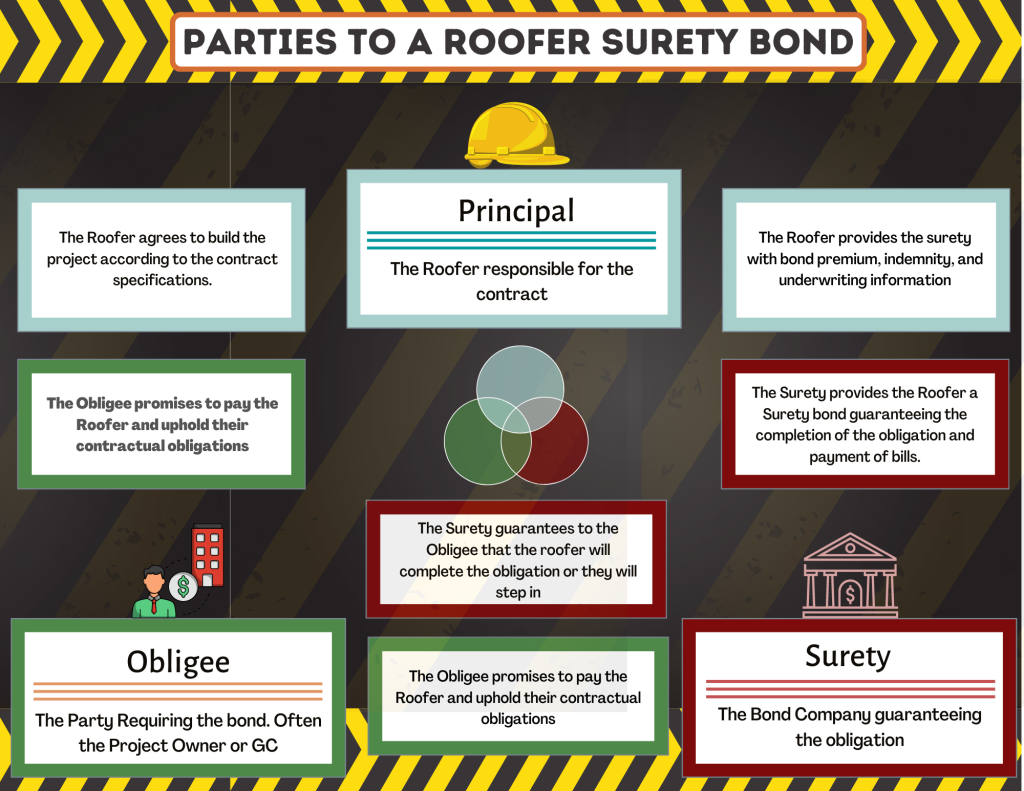

A Surety Bond is a three party agreement between a contractor (The Principal), a project owner (The Obligee), and a Surety Bond Company. The bond is a promise to fulfill an obligation to the project owner. If the contractor defaults on that promise, the surety bond company is responsible for correcting the issue or providing financial resources to do so. An Obligee could also be a lender such as a bank financing the project or another contractor such as the General Contractor on the project.

The most common types of surety bonds needed by roofers include Bid Bonds, Performance Bonds, Payment Bonds and Maintenance Bonds.

Bid Bonds

Bid Bonds guarantee that if the contractor is the selected low bidder, they will enter into a contract for the bid price. Bid Bonds protect against contractors changing their bids, and provide the Obligee financial protection if they must rebid the project or use the second bidder.

A secondary purpose of a Bid Bond is to prequalify the contractor. Because the bidding contract must be approved by a surety bond underwriter, some project owners and contractors use this as a way of qualifying roofers for their project.

Performance Bonds

Performance Bonds guarantee that a project will be completed according to the contract and at the contract price. Performance Bonds protect the Obligee from cost overruns on the project and help guarantee completion regardless of any challenges the contractor may be facing.

Payment Bonds

Payment Bonds guarantee that certain subcontractors and material suppliers will be paid on the bonded project. This helps keep subcontractors working on the Obligee’s project and protects the project from Mechanic’s Liens.

Maintenance Bonds

Maintenance Bonds guarantee that a contractor will correct defective work and material during the maintenance period. These are also referred to as “Warranty Bonds” by some owners. Maintenance Bonds are typically written for periods of 2 years or less. For roofers, it is common for a contract to require 2 year of maintenance on the construction and 20 years or more that is passed back to the manufacturer but not covered by the bond.

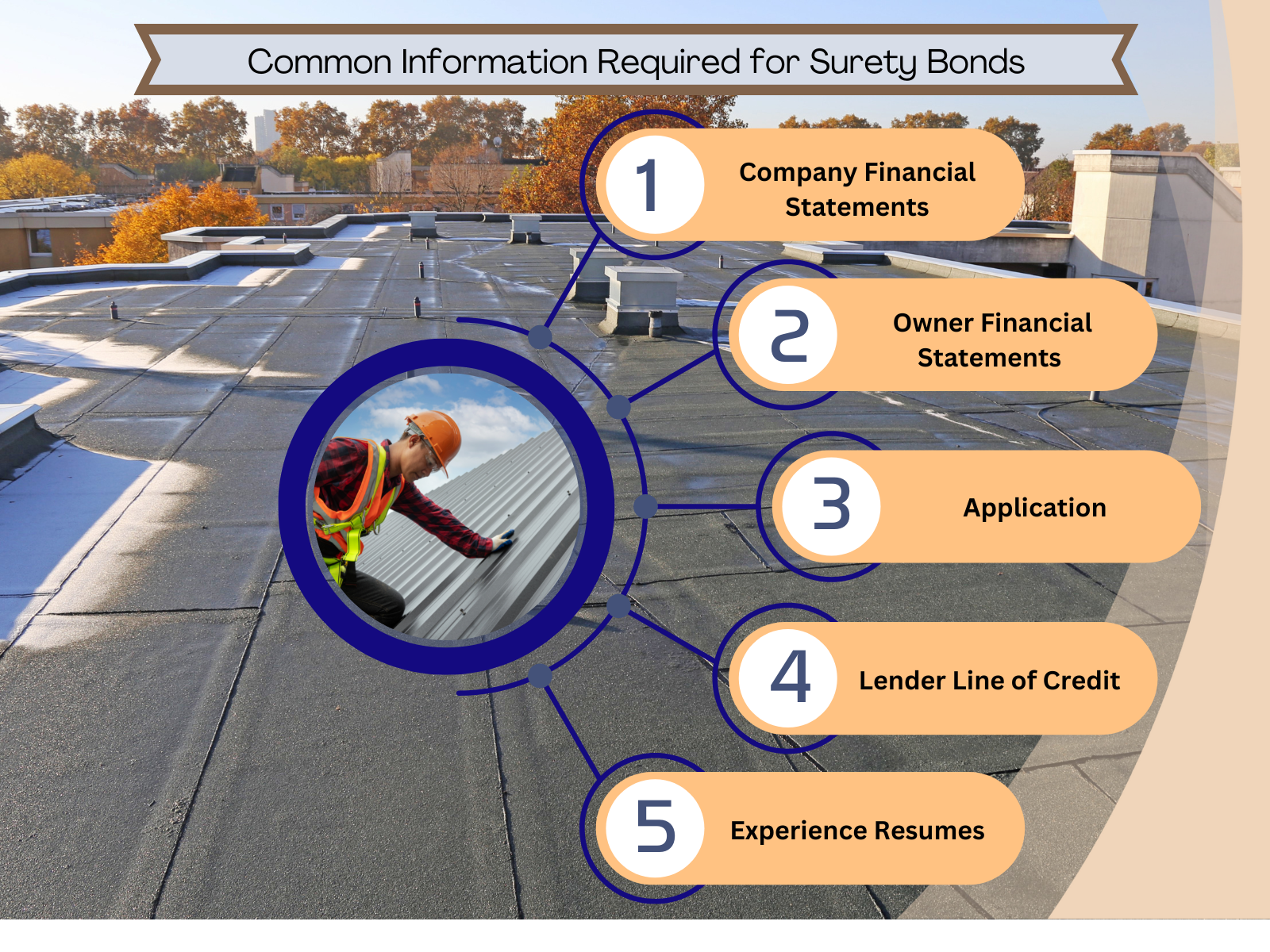

How Does a Roofer Get Set Up with a Surety Bond Program?

Fortunately for roofers, getting a surety bond program is easier than ever. Bond companies are providing bonds on projects as large as $1 million with a simple application and credit check on the owners. Larger programs may require the roofer to provide company and personal financial statements, banking information and prove they have the experience to complete the work.

Still, the surety bond market remains very soft and most roofers can easily obtain bonding. Roofers that have tried to get bonded in the past may be pleasantly surprised by changes in the bond market. It is better and more time consuming to get a program set up before the bond is required.

What Do Surety Bonds Cost?

Most brokers do not charge for bid bonds. Premium is only charged when a contractor is awarded a project and performance, payment or maintenance bonds are issued. Generally surety bonds cost 0.5%-3% of the contract amount depending on the financial strength of the roofer. The simple credit programs are the easiest to qualify for but also tend to be on the higher end of that range.

Surety Bonds are generally priced as a package, meaning there is only one charge for a performance bond, payment bond and maintenance bond on a single project. Maintenance is charged per year though, so maintenance periods longer than 12 months generally have a surcharge.

Opportunities for Roofers

As mentioned above, getting bonded provides roofers with opportunities to win additional work. Increasingly, owners on commercial projects are requiring roofers to provide bonds to protect themselves from price escalations, and labor shortages. It is not uncommon for a lender on a private project to require bonding as a condition of financing for the project. Not having the ability to bond can get the roofer disqualified from the project.

Even when bonds are not required, more owners and general contractors are asking for Letters of Bondability. These are letters written by a surety bond company or bond brokers stating that a roofer has the ability to provide bonds if required and in what amounts. It is becoming more common for these letters to be part of a General Contractor’s bid requirements. Additionally, roofers can proactively provide these letters as part of their marketing and qualification packages to differentiate themselves from competitors. Roofers who are able to provide these letters can open more doors and win more work, even when a surety bond is not required.

Other Benefits for Roofers

Roofers may find other benefits to working with a qualified bond company as well. Surety bond companies review contracts for clauses and terms that may be harmful to a roofer. These include contingent payment clauses, flow down clauses, damages and other provisions that may harm roofers.

Surety Bonds are Not Insurance

Although they are often written by insurance companies, surety bonds are not insurance. In fact, surety bonds required indemnity, meaning that if the bond company pays out a loss, they can seek reimbursement of the claim from the roofer and other indemnitors, which often includes stockholders and their spouses. In this way, surety bonds are closely related to a credit product. However, the bond company would not write bonds unless they believe the roofer could complete the underlying obligations.

Payment Bonds Provide Roofers with Valuable Protection

Although getting bonded can benefit roofers by getting more work, working for a “bonded” contractor can provide valuable protection. Not getting paid for their work is probably the biggest risk that every roofer faces. One bad project could even be enough to take a roofer out of business.

Working for an Owner or GC with a payment bond provides protection to the roofer. Should the roofer not get paid in a timely manner or according to the contract, the roofer can file a claim against the payment bond. Often, notifying the bond company is all it takes to speed up the payment.

It is important for roofers to understand that many Owners and GCs are using Subcontractor Default Insurance. This product protects the GC only and does not protect the payment rights of the roofer. It is not a substitute for a payment bond. Although most roofers cannot only work for Owners and GCs on bonded projects, they should price their work accordingly when the payment protection is not available.

Understanding and getting set up with a surety bond program can open opportunities for roofing contractors. The process should not be intimidating and can be set up quickly in most cases. Including a bond letter in your proposal may even be the tool needed to win the project.